Share

Should I take up a longer or shorter mortgage loan for my home?

When most people choose their mortgage loan package, they often ask themselves whether they want to go with a longer or shorter loan term. A shorter tenure would mean lesser interest paid and also the idea that you get to finish the repayment earlier in life sounds great. Meanwhile, a longer loan tenure means lower monthly installments and better cash flow for your everyday life

So which do you think is better?

In this article, let us explore the pros and cons of the different loan tenures.

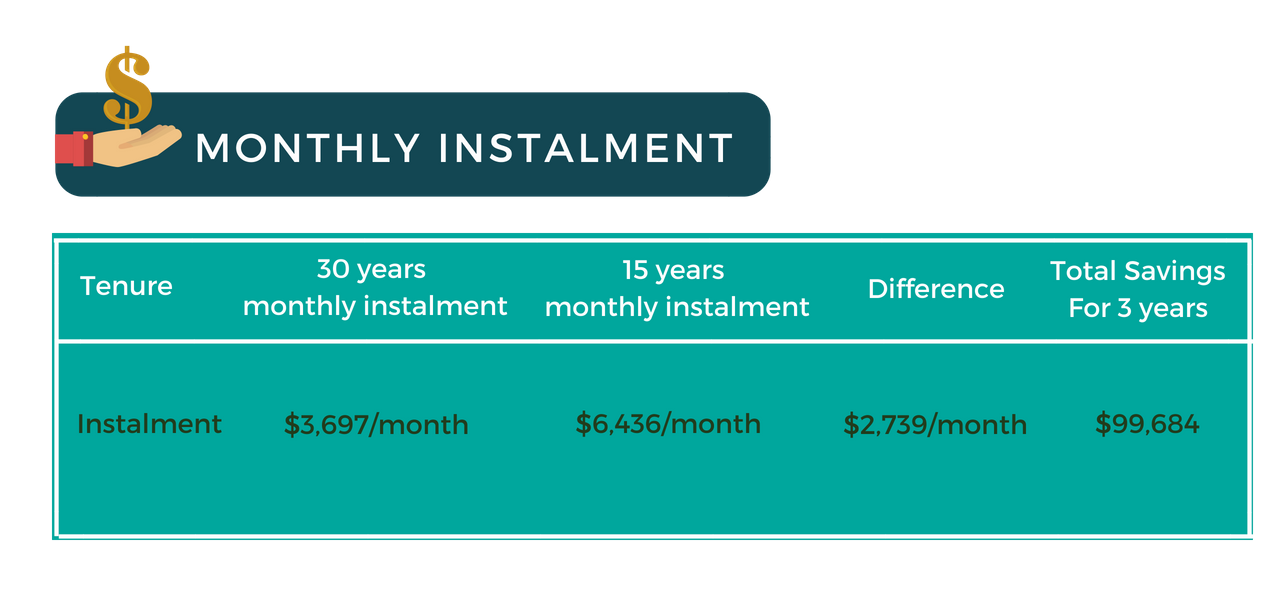

To illustrate, let us first take a look at an example below.

In general, people refinance their mortgage every 3 years to make sure they are on the best rates. Most people also have plans to sell/upgrade their property after 3-5 years once their family size and income grow. Therefore, the calculations below are based on a 3-year period

For a loan of $1 million @ 2% interest rates. Let’s look at the difference in the monthly installments between a 15-year and 30-year loan tenure.

Let us first look at the monthly repayment amount from this example. Certainly, when you double the time of the loan tenure, the monthly installment is lowered by almost half. As we can see from the table above, the 30-year loan tenure will save you $2,739/mth extra compared to the 15 years tenure. After 3 years, you will have $2,739X 36 months = $99,684 extra in terms of cashflow.

So how much extra interest did we have to pay to enjoy $99,684 extra cash flow for the 30-year loan?

After 3 years, the total additional Interest you have to pay between the 30-year and 15-year tenure is…… wait for it……$2,931, which works out to be an extra $81 interest a month.

Does this calculation shock you?

You accumulate an extra $99,684 in cash flow over 3 years, and the extra interest works out to be only $81 extra a month for the 30-year loan.

So you might be wondering… why is this the case?

Why is the difference in interest so small between the 30 and 15-year loan tenure, when the installment is almost doubled?

First of all, you need to know that interest on your mortgage loan is charged on the outstanding loan amount.

The outstanding loan amount in the first few years of the loan term is very similar between a 15-year loan or a 30-year loan. As seen in the example above, the difference is marginal.

The main difference will come in if the loan is held till the end of the tenure. However, most people tend to sell or upgrade after a few years. Otherwise, one can also arrange a prepayment to the loan when necessary.

So, what will all this mean to a property owner? Here are the 3 benefits of getting the maximum tenure:

- Now that we are aware that the additional interest is minimal, the question is, what are you going to be doing with that extra cash flow if you go for the longer loan tenure? Are you going to end up splurging it on that branded bag or toy? Or will you be investing it at a higher rate of return than your mortgage loan?

- Perhaps you will be saving it for a rainy day fund as covered in the next point. Well, at least with a lower monthly repayment, you have the flexibility to decide! Even better, if your loan comes with prepayment option, you can still choose to use that additional cash flow to pay down your loan at a faster pace.

- Along the same line as point 1, the flexibility that comes with a lower fixed monthly commitment allows you to prepare for unforeseen circumstances. Whether it is to deal with a temporary loss of income, unplanned large expenses, or an interest rate hike, having a buffer will put more control in your hands in such situations.

- To further touch on the impact of government regulations, TDSR (Total Debt Servicing Ratio) is something that a savvy property owner should be familiar with. TDSR was implemented in 2013 and has changed the way in which people can take up loans. Not only does it affect how much mortgage loan you can take up, it also takes into consideration all the different types of loan.

- That being said, TDSR calculation involves the monthly loan commitment over monthly income. Having a lower monthly loan commitment will give you the ability to get a higher loan quantum for the next loan, should there be regulatory changes. As for property investors, this will play a crucial part when you wish to buy subsequent properties.

Conclusion

So there you have it; there are many benefits to having a longer loan tenure.However, if you happen to fall into the category where you have too much money sitting around and you won’t need to worry about cash flow issues and you also do not believe in investing, you can consider fully paying off your mortgageHaving said all these, there is no one right answer when it comes to how long the loan tenure should be.

Hopefully, these pointers will be useful for homeowners to assess their own standing and preferences. If you have any personalized questions, feel free to speak to one of our expert mortgage advisors by contactings us at (+65) 6631 8980 (main line). Do leave us a comment in the section below! Follow us on Facebook, Instagram and website for a daily dose of quick financial tips and deals! Thanks for reading!